Step-by-Step Instructions for Completing Your Online Tax Return in Australia Without Mistakes

Step-by-Step Instructions for Completing Your Online Tax Return in Australia Without Mistakes

Blog Article

Navigate Your Online Income Tax Return in Australia: Important Resources and Tips

Navigating the on-line income tax return process in Australia requires a clear understanding of your responsibilities and the sources available to improve the experience. Necessary records, such as your Tax Obligation Data Number and revenue declarations, have to be carefully prepared. In addition, picking a proper online system can significantly impact the performance of your declaring procedure. As you take into consideration these variables, it is critical to additionally know common challenges that several experience. Recognizing these subtleties might eventually save you time and lower stress-- leading to an extra positive result. What methods can best help in this endeavor?

Comprehending Tax Obligation Responsibilities

People must report their earnings properly, which consists of incomes, rental earnings, and financial investment earnings, and pay taxes as necessary. Residents have to comprehend the distinction in between non-taxable and taxable income to make sure conformity and enhance tax results.

For organizations, tax obligation obligations include several aspects, consisting of the Product and Services Tax Obligation (GST), firm tax, and payroll tax obligation. It is essential for businesses to sign up for an Australian Service Number (ABN) and, if appropriate, GST enrollment. These responsibilities require precise record-keeping and timely entries of income tax return.

Additionally, taxpayers should know with offered deductions and offsets that can alleviate their tax obligation concern. Seeking guidance from tax obligation experts can provide beneficial understandings into maximizing tax placements while making certain conformity with the legislation. Overall, a thorough understanding of tax commitments is crucial for effective monetary preparation and to prevent charges related to non-compliance in Australia.

Vital Records to Prepare

Furthermore, assemble any appropriate bank statements that show rate of interest revenue, as well as dividend statements if you hold shares. If you have various other income sources, such as rental homes or freelance job, ensure you have documents of these earnings and any connected costs.

Consider any kind of private wellness insurance statements, as these can impact your tax commitments. By gathering these essential records in breakthrough, you will certainly enhance your online tax return process, lessen errors, and make best use of prospective refunds.

Choosing the Right Online Platform

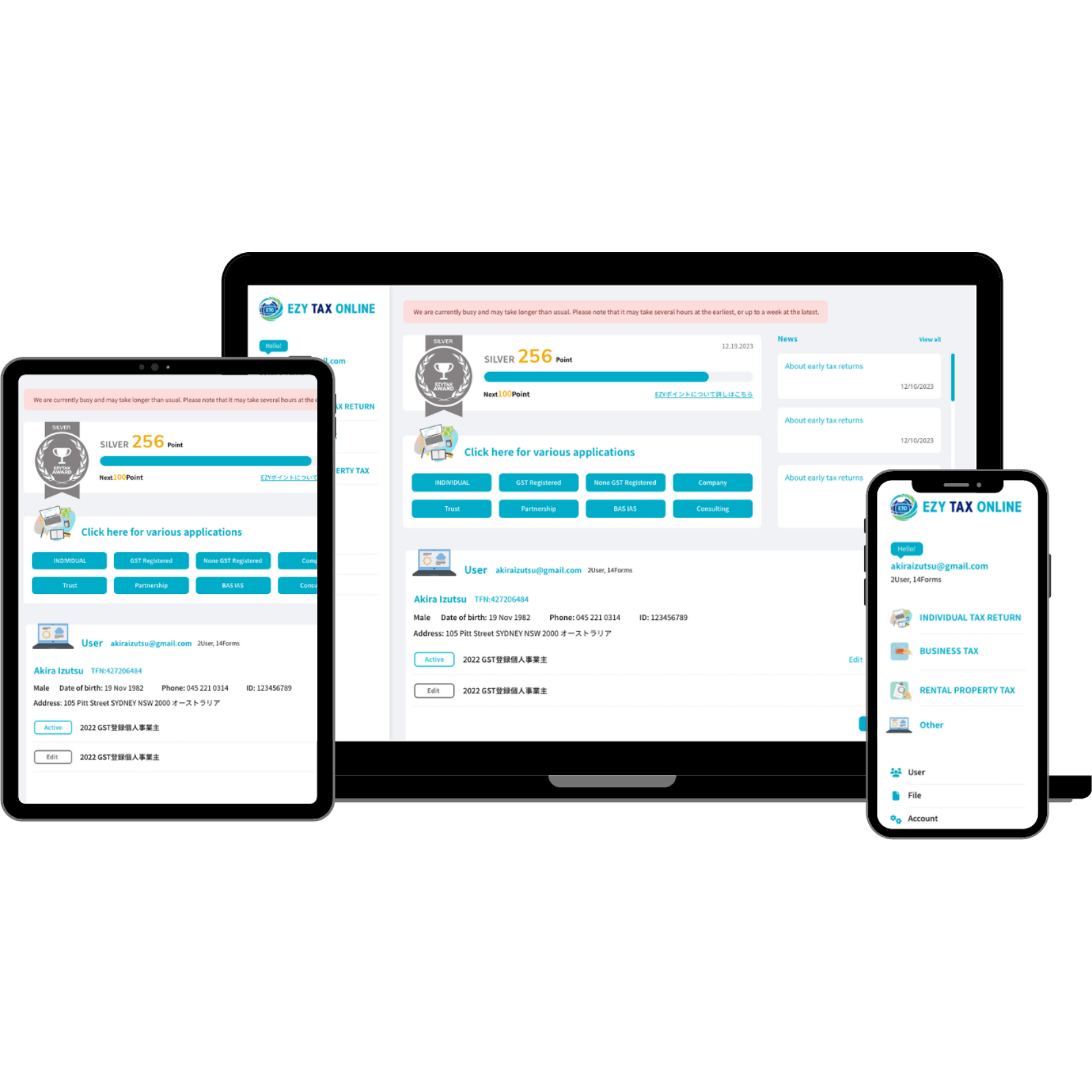

As you prepare to submit your online tax obligation return in Australia, selecting the appropriate platform is vital to make certain accuracy and convenience of usage. Numerous essential variables should assist your decision-making process. Consider the platform's customer interface. An uncomplicated, instinctive design can dramatically enhance your experience, making it simpler to browse intricate tax types.

Following, analyze the platform's compatibility with your monetary circumstance. Some solutions provide especially to people with basic tax returns, while others provide thorough assistance for extra complex scenarios, such as self-employment or investment revenue. Furthermore, search for platforms that provide real-time error checking and support, assisting to lessen errors and ensuring conformity with Australian tax obligation regulations.

An additional essential facet to consider is the degree of client assistance available. Dependable platforms need to offer accessibility to aid using chat, phone, or email, specifically during top filing periods. In addition, research study user reviews and ratings to gauge the total fulfillment and dependability of the platform.

Tips for a Smooth Filing Refine

Submitting your online tax obligation return can be an uncomplicated process if you comply with a few essential pointers to guarantee efficiency and precision. This includes your earnings declarations, invoices for deductions, and any other appropriate documentation.

Next, make the most of the pre-filling function provided by several on-line platforms. This can save time and decrease the chance of errors by automatically occupying your return with details from previous years and data given by your employer and banks.

Furthermore, verify all access for hop over to here precision. online tax return in Australia. Blunders can lead to delayed reimbursements or concerns with the Australian Taxes Workplace (ATO) Make certain that your individual information, revenue numbers, and reductions are proper

Be conscious of deadlines. Declaring early not just lowers stress however likewise allows for far better preparation if you owe tax obligations. If you have unpredictabilities or questions, consult the aid areas of your selected platform or seek expert guidance. By following these tips, you can browse the online tax obligation return process smoothly and confidently.

Resources for Aid and Support

Browsing the complexities of on-line tax obligation returns can in some cases be complicated, but a selection of sources for help and support are easily offered to help taxpayers. The Australian Taxation Workplace (ATO) is the main resource of information, using extensive guides on its internet you can try here site, consisting of Frequently asked questions, instructional videos, and live conversation alternatives for real-time support.

In Addition, the ATO's phone assistance line is offered for those that choose straight interaction. online tax return in Australia. Tax specialists, such as authorized tax obligation representatives, can also give customized assistance and make sure conformity with current tax obligation guidelines

Conclusion

Finally, efficiently navigating the online tax return process in Australia needs a detailed understanding of tax obligation responsibilities, thorough prep work of essential documents, and mindful option of a proper online system. Sticking to functional ideas can improve the filing experience, while available resources offer valuable aid. By coming close to the procedure with persistance and find interest to information, taxpayers can make certain conformity and maximize potential advantages, eventually contributing to an extra reliable and effective tax obligation return result.

As you prepare to file your online tax obligation return in Australia, selecting the appropriate platform is crucial to make certain precision and ease of usage.In conclusion, successfully navigating the on-line tax return procedure in Australia requires a detailed understanding of tax responsibilities, precise preparation of necessary documents, and cautious option of an appropriate online system.

Report this page